capital gains tax proposal washington state

The tax measures are contained in the governors two-year 576 billion operating budget proposal released Thursday in advance of the 2021 Legislative session. It taxes out-of-state earnings and out-of-state activity.

Property Taxes Property Tax Analysis Tax Foundation

Washington state Gov.

. However many sales of assets by a business entity are not capital in nature such as sales of inventory. On May 4th Gov. For example if your annual gains are 249999 no additional tax is incurred.

Just like at the federal level under the proposed Washington capital gains tax when a pass-through entity sells a long-term capital asset the capital gain would be reported and paid by the entity owners. This measure would repeal a 7 tax on annual capital gains above 250000 by individuals from the sale of stocks and certain other capital assets exempting for example real estate and retirement accounts. OLYMPIA Wash A proposed tax on capital gains which are profits made on investments would generate more than a billion dollars for state services and help the state deal with the COVID.

For the tax to kick in an individual. Senate Bill 5096 sponsored by Sen. Jay Inslee on Thursday unveiled a budget proposal for 576 billion in general fund spending and a capital gains tax for the 2021-23 biennium.

Many forms of assets are also. Separately the Democratic governor also released proposed capital construction and transportation budgets. SB 5096 would impose a 9 income tax on capital gains in Washington state.

This proposal would tax individuals for the sale or exchange of capital assets they have held for more than one year unless an exemption applies. The state would apply a 79 percent tax to capital gains earnings above 25000 for individuals and 50000 for joint filers. Proposed Washington Capital Gains Tax.

Although the ballot measure asking voters to recommend. While the appeal is pending the Department will continue to provide guidance to the public regarding the tax as a. The new law will take effect January 1 2022.

To see what Gov. Governor Inslee is proposing a capital gains tax on the sale of stocks bonds and other assets to. The tax would equal 9 percent of your Washington capital gains.

On November 2nd Washington lawmakers will learn what voters think about it. Prepared by the Department of Revenue. Per-Capita Inflation adjusted state spending has more than doubled since 1970s.

This proposal is effective January 1 2022 with the first capital gains tax return due April 15 2023. Proponents of a capital gains tax in Washington have long sought to argue that the tax can be designed as an excise tax rather than an income tax to avoid constitutional constraints imposed on income and property taxation in the state. A warning from France on wealth taxes.

Among the most controversial elements of the proposal is a proposal that would make Washington the only state to tax capital gains but not impose a general income tax. Jay Inslee signed a critical piece of tax reform legislation. The bill would levy a 7 tax on the capital gains from sales of assets like stocks and bonds that exceed 250000.

If theyre 250050 you incur a 7 state tax on that extra 50. Sales of anything under 250000 are exempt. 5096 which was signed by Governor Inslee on May 4 2021.

Continue Reading Governor Dusts Off Washington Capital Gains Tax Idea Proposes Insurance. Washington State Capital Gains Tax Senate Bill 5096 levies a 7 tax on Washington residents annual long-term capital gains exceeding 250000. The capital gains tax proposal also includes a credit for taxes paid through the Real Estate Excise Tax.

Jay Inslee D signed legislation creating a 7 percent capital gains tax to take effect next year. The 2021 Washington State Legislature recently passed ESSB 5096 which creates a 7 tax on the sale or exchange of long-term capital assets such as stocks bonds business interests or other investments and tangible assets. Washington Voters to Weigh in on New Capital Gains Income Tax.

Inslee proposed in his 2021-23 budget see Gov. The 7 capital gains tax applies to profits from selling long-term assets such as stocks and bonds. This proposal impacts approximately 58000 taxpayers and will impact the state general fund in the following ways.

Inslee proposes a capital gains tax on the sale of stocks bonds and other assets to increase the share of state taxes paid by Washingtons wealthiest taxpayers. The bill is part of a multi-year push by the legislature to rebalance a state tax system that it calls the most regressive in the nation in Section 1 of the bill by increasing. Powerpoint presentation on the proposed Income Tax on Capital Gains from Jason Mercier.

Washington Capital Gains Proposal Not Helped by Analogy to Real Estate Excise Tax. 10 11 Washington Secretary of State Proposed 2022 Initiatives to the People accessed January 21 2022. Washingtons legislature passed a new capital gains tax in April Engrossed Substitute SB.

New state tax proposals examined by Jason Mercier. June Robinson D-Everett enacts a capital gains excise tax to fund the expansion and affordability of child care early learning and the states paramount duty to provide an education for the. No capital gains tax currently exists in Washington at the state or local level.

Capital assets are personal property you own for investment or personal reasons and do not usually sell in the course of business. Critics of the plan have already documented how capital gains taxes substantially increase tax volatility but to many it may not be obvious just how volatile capital gains can be. Washingtons capital gains tax is designed as a direct tax not an indirect one.

Inslees 21-23 capital gains tax proposal QA. FOR IMMEDIATE RELEASE. As a percentage of household income low-income families pay nearly 18 in taxes middle-income families pay 11 and the states highest income households pay 3 or less.

State of Washington that the capital gains excise tax ESSB 5096 does not meet state constitutional requirements and therefore is unconstitutional and invalid. If we accept the states argument that its an excise tax then its probably an unconstitutional one because it fails to meet the nexus requirements established in cases like Complete Auto Transit v. Washington State has the most regressive tax code in the nation.

OLYMPIA Earlier today Gov. Capital gains tax QA 2019-21 proposal This information relates to a capital gains tax as proposed in 2018. The State has appealed the ruling to the Washington Supreme Court.

2.png)

How High Are Capital Gains Tax Rates In Your State Tax Foundation

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

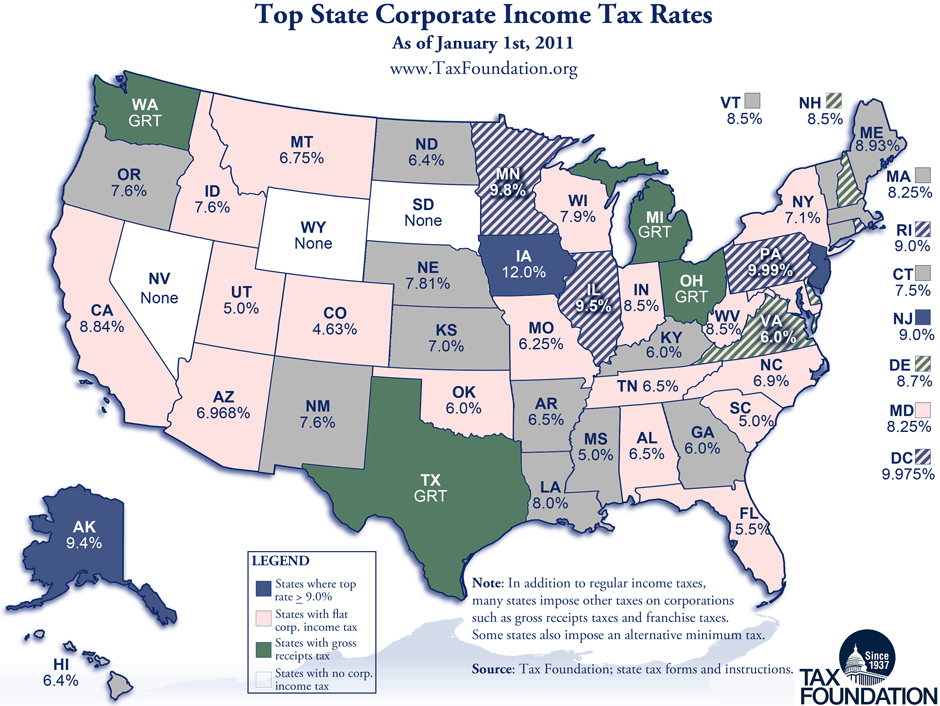

Monday Map State Corporate Income Tax Rates Tax Foundation

Does Your State Have A Gross Receipts Tax State Gross Receipts Taxes

Maryland Tax Rates Rankings Maryland State Taxes Tax Foundation

Does Your State Have A Gross Receipts Tax State Gross Receipts Taxes

Does Your State Have An Individual Alternative Minimum Tax Amt

State Corporate Income Tax Rates And Brackets Tax Foundation

Internet Sales Taxes Tax Foundation

State Tax Maps How Does Your State Rank Tax Foundation

Property Taxes Property Tax Analysis Tax Foundation

How Do State And Local Corporate Income Taxes Work Tax Policy Center

New Taxes Will Hit America S Rich Old Loopholes Will Protect Them The Economist

Tax Burden By State 2022 State And Local Taxes Tax Foundation

Property Tax Map Tax Foundation

How Do State And Local Sales Taxes Work Tax Policy Center

How Do State And Local Individual Income Taxes Work Tax Policy Center

Arizona Tax Rates Rankings Arizona State Taxes Tax Foundation

Maryland Tax Rates Rankings Maryland State Taxes Tax Foundation